Ira Limits 2025 Income Limits Over 65. These charts show the income range in which your deduction may be disallowed if you or your spouse participates in a retirement plan at work: Those age 50 and older can contribute an.

Find out if you can contribute and if you make too much money for a tax deduction. The total contribution limit for iras in 2025 is $7,000.

Ahcccs 2025 Limits For Seniors Over 65 Jamie Giacinta, You can contribute a maximum of $7,000 (up from $6,500 for 2025).

Roth Ira Limits 2025 Eleni Hedwiga, The ira contribution limits for 2025 are $7,000 for those under age 50, and $8,000 for those age 50 or older.

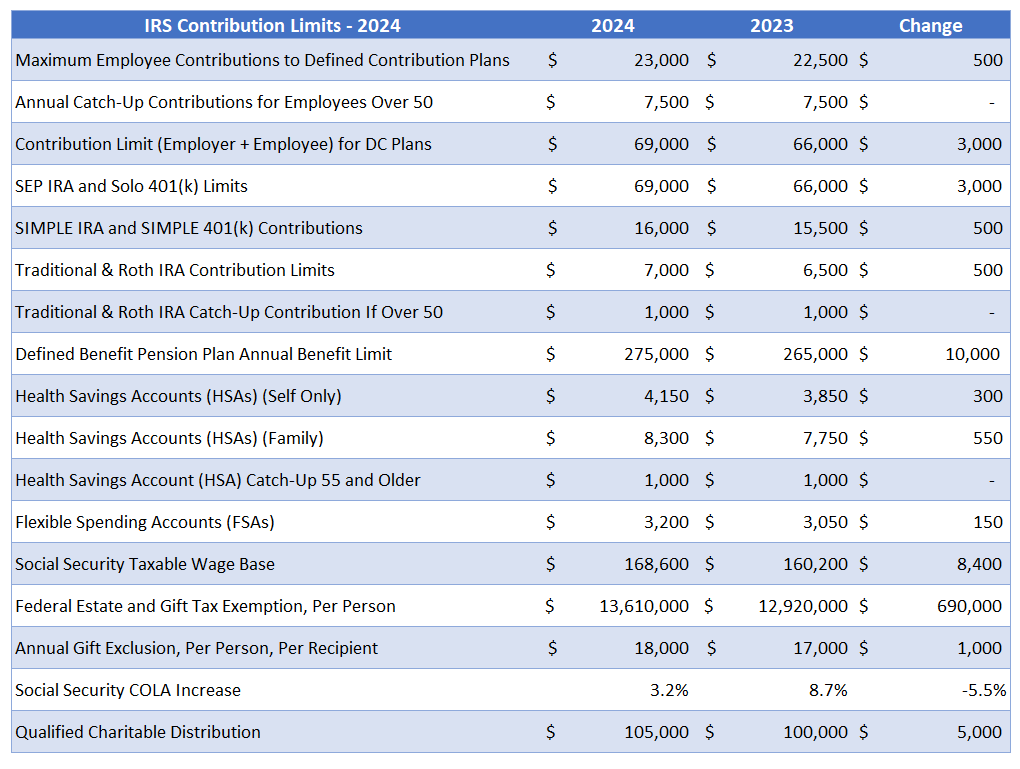

2025 Contribution Limits Announced by the IRS, The 2025 annual ira contribution limit is $7,000 for individuals under 50, or $8,000 for 50 or older.

2025 IRS Contribution Limits For IRAs, 401(k)s & Tax Brackets, Learn how ira income limits vary based on which type of ira you have.

Hsa Contribution Limits 2025 Irs Over Age 65 Melly Leoline, The income ranges on iras are also higher in 2025, allowing you to.

IRA Contribution Limits in 2025 Meld Financial, The irs left contribution limits to traditional and roth iras unchanged for 2025, keeping them at their 2025 level of $7,000.

2025 ira contribution limits Inflation Protection, You can contribute a maximum of $7,000 (up from $6,500 for 2025).